- The EV Universe

- Posts

- DEEPER LOOK: Tesla now sells its Supercharger hardware.

DEEPER LOOK: Tesla now sells its Supercharger hardware.

bp pulse buys $100M worth of Tesla superchargers

DEEPER LOOK: Tesla now sells its Supercharger hardware.

Yeah, you read that right. bp pulse will be the first to buy $100M worth of Tesla ultra-fast chargers and deploy them on their own independent network. Here’s what I gathered from the press release (link):

Rolls out as early as 2024.

Tesla 250kW chargers

With Magic Docs, so both NACS and CCS capable

Will be installed and managed by bp pulse.

Will run on Omega, bp’s software platform. Although it’s conveniently put in the EV fleet hubs section in the press release, perhaps the public ones will run on Tesla charging OS?

Will feature Plug&Charge

First sites will be in Houston, Phoenix, Los Angeles, Chicago; and Washington D.C., for bp brands like TravelCenters of America, Thorntons, ampm; and Amoco. It’ll also launch in private EV fleet depots and in some Hertz locations.

This is a big deal. ICE car drivers will get to see fast chargers wherever they refuel at BP-owned stations, which is great for EV transition. On top of that, more fast chargers for EV owners. It's such a win-win.

"At Tesla, we’re driven to enable great charging experiences for all EV owners. Selling our fast-charging hardware is a new step for us, and one we’re looking to expand in support of our mission to accelerate the transition to sustainable energy. We appreciate bp’s partnership in this area – it’s the right step towards a more sustainable future."

Now how many Superchargers will bp pulse get for said $100M?

How much does a Supercharger cost?

Short answer: we don’t know. This will probably start coming out as more third parties do a similar deal. Until then, here’s what I know:

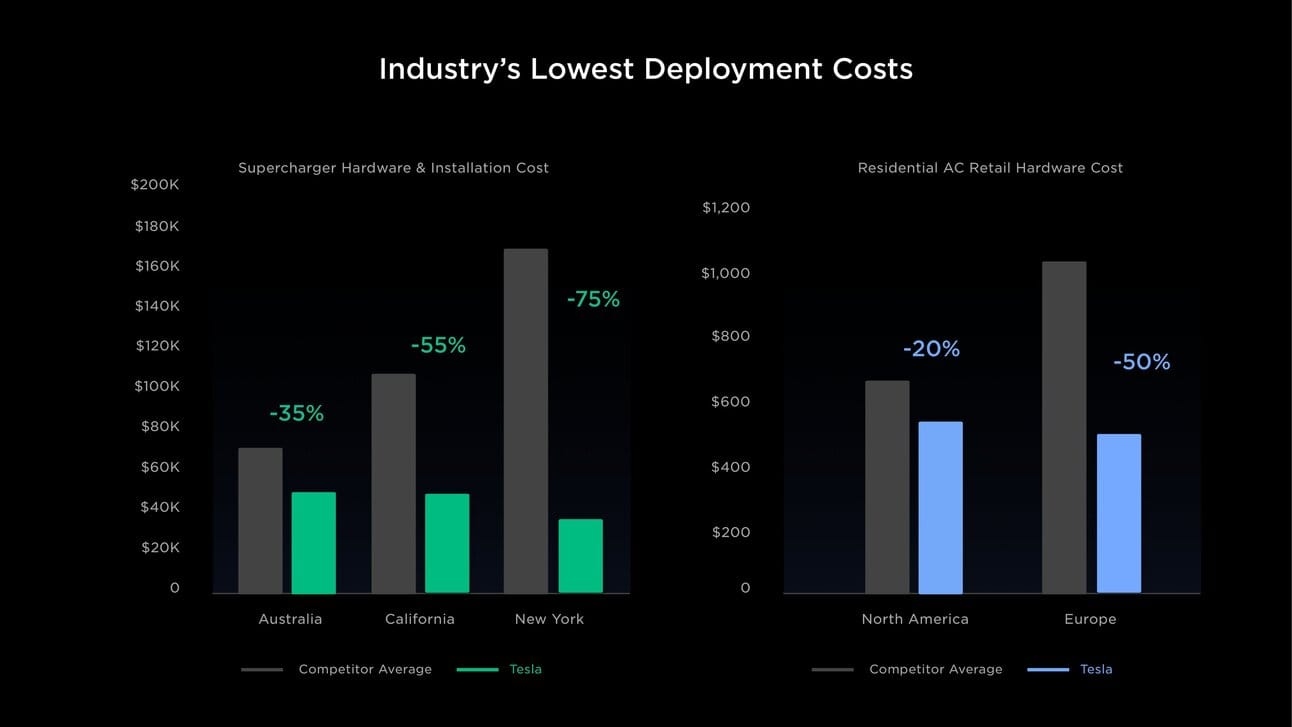

We saw from an Investor Day deck a bit back that Tesla’s Supercharger Hardware and Installation costs were between $30k and $45k in the US.

As hardware costs would be the same across US (except shipping), I think it’s safe to assume we can go with the lower number of $30k per unit. And mind you, this is with installation.

At $30k, bp Pulse would get 3,333 Supercharger units. I would assume a larger price (more aligned with rest of the industry), and will report back when we get more info.

With the NEVI grants rolling out in several states, Tesla has shown superiority over other charge point operators (CPOs) with significantly lower deployment costs already. Is there a scenario here where Tesla earns a significant margin and the offer is still the most competitive offer for these CPOs? Not to mention the added benefits of using what most of the industry says is the most reliable charging system deployed so far.

Tesla also wins because it can either increase its utilization of existing Supercharger manufacturing lines (if there is such room) or because it can use this to expand its production capacity further. I’m very curious about the production capacity at its current stage.

What Tesla can lose is the image of the major charger reliability (even if rebranded as bp, for example), in cases where it doesn’t control the end experience anymore — even more so if it doesn’t control the software platform the run on either.

And if nothing else, bp pulse just bought a wonderful advertising campaign for just $100M. In a lot of eyes, the otherwise slightly tainted view of its charging experience went 📈.

I would imagine Tesla has a massive inbound request flow from CPOs across the world at this very moment. In case you want to share just this deeper look with others, I uploaded it as a standalone article on our site here.

Oh and what does Jaan do right after reading this news On Thursday? He makes memes.

Reply